Mortgage leads are one of the more costly lead types to generate on 3rd party platforms. Whether you are using directory advertising, utilizing PPC campaigns, or are a preferred listing on Zillow or Bankrate, this is clear. You pay big money for each mortgage lead, so you need to maximize its potential. We can help you maximize each lead.

Create a Mailparser account

Mortgage broker tools come in all types

LO’s and mortgage brokers alike know, the more information you have on each mortgage lead the better. Creating prospect data fields in your lead generation program, from name and contact number, to credit rate, finance amount and more, often are significant attributes that assist loan professionals in pre-qualifying. Also ensuring lenders are being efficient with their clients time, in regards to response time and providing them the information that they need in return. Most broker sites & 3rd party lead generation platforms have mortgage calculators, amortization schedules, and current loan rates, but the real advantage is discovered when the lead lands in your email inbox.

Parse what you need from each mortgage lead and respond faster with our email parser’s help

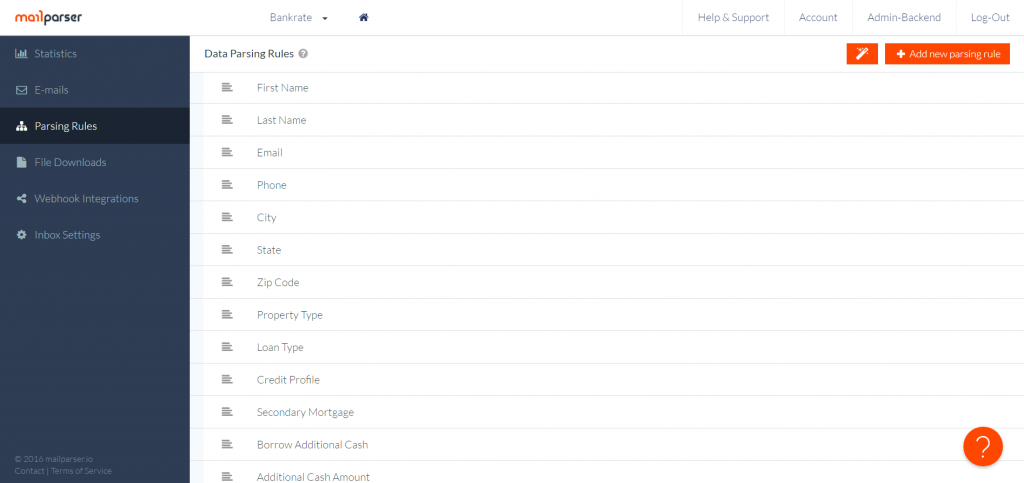

How? If you are an aggressive marketer, like many of our clients, then you generate leads from website forms, contact requests, and 3rd party lead generation platforms. The good news is that you can create a lot of inbound mortgage lead volume. The bad news? You have all these leads coming to your email inbox in different formats, with different field names, which can be quite frustrating. Instead, use Mailparser to extract precisely the email information you want from each of your channels. Doing this allows you to structure all of the data, send it automatically to a Google Sheet, your Salesforce account, download the results if you like, even send the data from the emails to Zapier, where it can then be sent to 100’s of other apps. Below is a typical “inbox” of parsing rules set to extract mortgage lead data.

How does using Mailparser make my mortgage leads better?

Easy, we make you more efficient, more accurate, and you give a leg up on your competition, because our emails are parsed in real time, so each lead is sent exactly where you want, automatically. This means that soon after that email hits your inbox, our integrations will allow it to be available in your CRM, a triggered email campaign, even have LO’s start putting dials on prospects from the parsed data, and introduce your services to each mortgage client in a snap. There is no more “Did you already call this person” among staff, and fewer “I’ve already committed to another lender” from prospects. The rotation of leads within your team is clear, as each lead has a time processed stamp. You can get back to the mortgage lead prospect so quickly, that you often still catch them thinking about the mortgage process, as they have just submitted the form mere minutes before.

Mailparser offers a free free subscription and our pricing plans are based on the volume of emails you choose to parse each month. Have questions? Contact us for more information.