As an insurance broker, leads are the lifeblood of your business.

However, managing and organizing leads can be overwhelming when you receive a lot of emails from multiple channels.

The process of entering lead data into your database is time-consuming and error-prone, which can cost you many opportunities — in fact, contacting leads before your competitors is essential to your success. So you need to learn how to manage insurance leads more efficiently.

If your inbox is full of lead emails with different formats, and you’re looking for a tool to extract lead data easily, then you’re at the right place. In this article, we will take a look at a case study of an insurance brokerage that uses Mailparser to streamline their lead management and stay on top of every opportunity. Specifically, we’ll examine the challenges they faced, how they use Mailparser to extract lead data, and the results they were able to achieve.

Let’s dive in.

Extract Data from Emails with Mailparser

Save countless hours of tedious data entry and streamline your document-based workflows.

No credit card required.

The Challenges Faced by the Insurance Broker

Simon is an IT director for an insurance brokerage firm that receives emails from insurance carriers and potential customers through various channels, including email. Prior to using Mailparser, the company relied on manual data entry in their lead management process. Let’s go over the three main challenges they were facing before using Mailparser.

The daily struggle of data entry

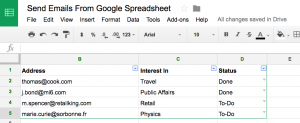

Every day, Simon and his team receive PDFs from various sources in different formats and with different data fields. Before using Mailparser, the company relied primarily on manual data entry. Employees had to input all the relevant data fields into Salesforce, such as:

- Name

- Phone number

- Email address

- Age

- Occupation

- Marital status

- Credit score

- Current insurance policy

- Etc.

Each lead has a lot of information that must be entered in Salesforce. The whole process was cumbersome, error-prone, and took up valuable time that could have been better spent on following up with leads and figuring out the best insurance coverage for each one.

Wrestling with different email formats and structures

The emails received by the sales team are sometimes inconsistent in format and structure, making it difficult to standardize and centralize everything into one database. For example, different emails may contain varying data fields such as name, address, contact information, and specific details about the lead’s insurance needs.

Slow response times that hurt the broker’s competitiveness

Being among the first brokers to contact a lead is crucial for success in the insurance industry. However, the sales team often had to spend hours looking through emails to identify and copy the relevant data fields. This often meant that they were losing out on potential clients.

In the end, manual data entry was not only time-consuming and stressful, but also very costly. The insurance brokerage was struggling to grow their revenue and bottom line, so the company started looking for ways to automate lead capturing. Thankfully, they found the solution they were looking for with Mailparser.

Extract Data from Emails with Mailparser

Save countless hours of tedious data entry and streamline your workflows.

No credit card required

The Solution: Using Mailparser to Manage Insurance Leads

Mailparser’s customer happiness team provided assistance throughout the onboarding process, ensuring a smooth transition for the insurance broker. Simon and the other users received prompt responses to any questions and concerns they had, making the implementation process quick and hassle-free.

By using Mailparser, the company is now able to extract lead data from emails and have it automatically sent to Salesforce. The sales team no longer has to manually sift through countless emails to locate and enter lead data. The automation of this process saves them several hours per week and empowers them to reach out to leads much faster than before.

Also, by centralizing all lead data in one CRM, the insurance broker is able to streamline the process of sharing lead data within the team. The use of email parsing for insurance leads also reduced the risk of errors, allowing agents to make more informed decisions based on accurate data.

Overall, Mailparser proved to be the perfect fit for the brokerage’s data extraction needs. Its user-friendly interface, customization options, and responsive support made it a clear choice for insurance brokers looking to streamline their lead management process.

If, like this company, you are looking for a reliable tool to automate data entry, here is how to manage insurance leads with Mailparser.

Extract Data from Emails with Mailparser

Save countless hours of tedious data entry and streamline your workflows.

No credit card required

How to Manage Insurance Leads with Mailparser

Mailparser is a web-based email parser used by hundreds of businesses to extract key data from emails. It requires no coding skills and can be set up in minutes. Here is how to manage insurance leads with Mailparser, step by step:

1. Sign up for a free account

The first step is to sign up for a Mailparser account. You can use a 21-day free trial and upgrade to a paid plan later.

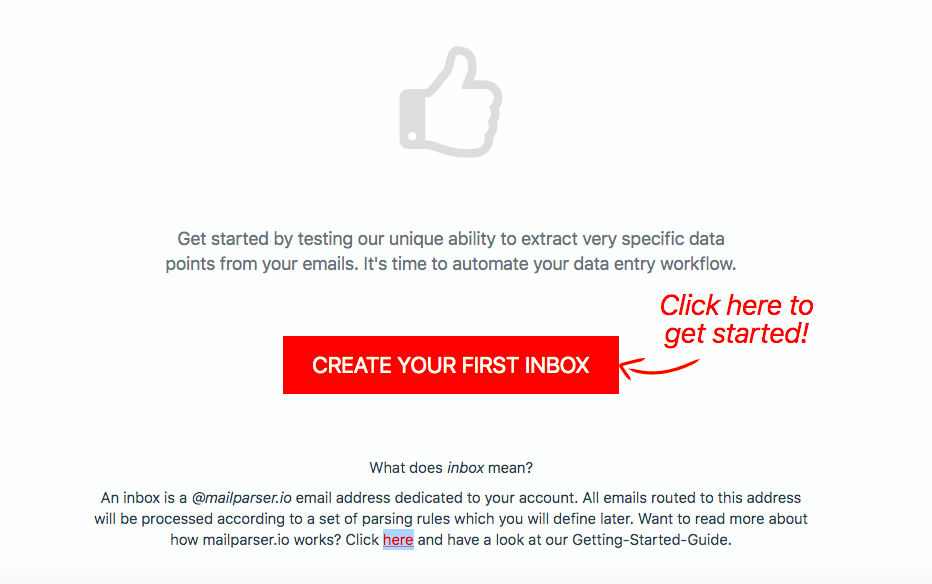

2. Create a Mailparser inbox

Once you’ve signed up, Mailparser will prompt you to create your first inbox. Click on the button and Mailparser will generate a unique email address for you.

This is where you’ll forward your emails to be parsed. Note that you can set up multiple inboxes for different lead sources.

3. Forward an email to Mailparser

Next, you need at least one test email to set up your email parser. Select one email or more from your inbox and forward it to Mailparser. Mailparser will automatically attempt to parse that email and extract the data inside.

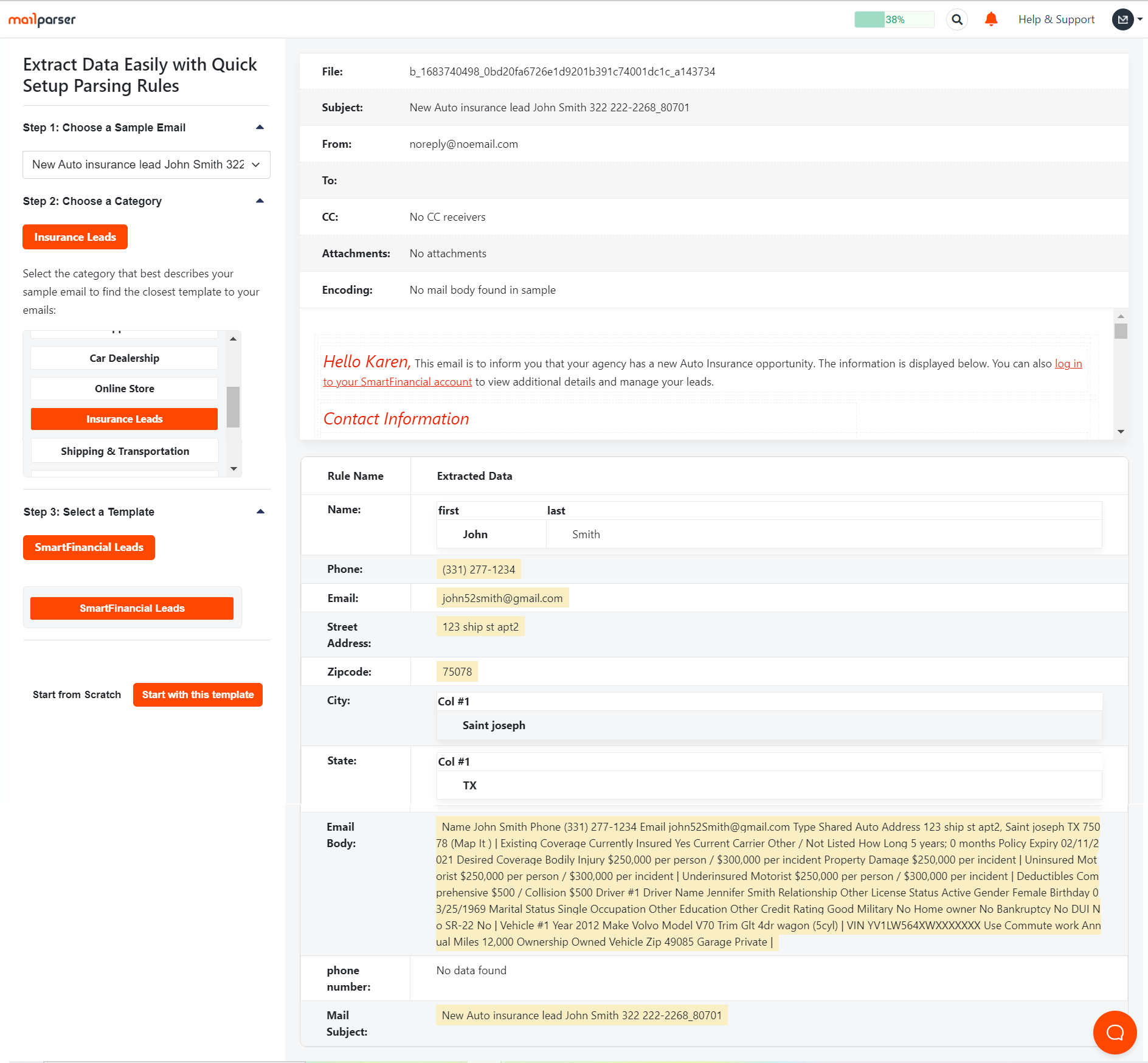

4. Create parsing rules

Parsing rules are the instructions that Mailparser follows to identify and extract data from emails. You will need a parsing rule for each data field (name, phone number, email address, etc.).

Luckily, Mailparser has a large library of templates for various use cases, including templates for the insurance industry. For example, if you receive emails from EverQuote, Mailparser will use a template specifically made for that website and create parsing rules to extract the lead information found in those emails.

So after forwarding an email, select “Try Automatic Setup” from the “Parsing Rules” section. Mailparser will detect the correct template to use based on the email contents, and automatically create parsing rules for the relevant data fields.

You can then see the parsing rules that Mailparser attempted to create along with the extraction results. Moreover, you can create custom rules and define how each data field should be extracted. For example, you can:

- Set a start and end positions for a data field

- Remove empty lines

- Find specific keywords

- Change the formatting of a date

- Etc.

Once you are done creating your parsing rules, it’s time to test them. Mailparser will show you a preview of the extracted data, so you can make sure everything looks correct. You can always edit your rules or add new ones to refine the parsing results.

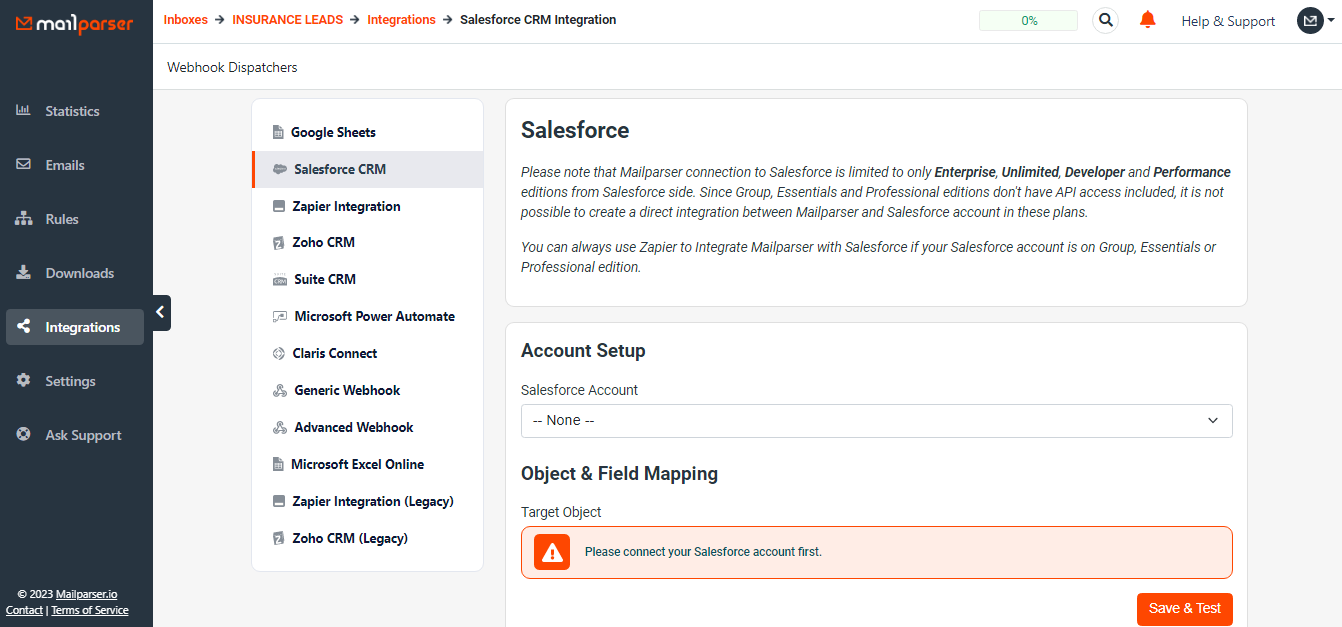

5. Set up your CRM integration

The last step of setting up your custom email parser consists of creating an integration with your CRM. Mailparser can integrate with many CRM platforms, including Salesforce, Hubspot, and Zoho to mention a few.

Essentially, you need to select an integration option, log in to your account on your CRM, and choose the location where you want parsed data to be sent. You’ll be asked to map your data to the appropriate fields in your CRM. This is a one-time process, and Mailparser will remember your mappings for future emails.

After sending test data to make sure that your integration is working correctly, you can start to extract insurance leads from emails. Mailparser will automatically parse new emails and send the extracted data to your CRM, all in just a few moments!

Alternatively, you can download parsed data to a file in the following formats: Excel, CSV, JSON, and XML.

The Results That the Insurance Broker Achieved

After implementing Mailparser to extract lead data from emails, the insurance brokerage saw significant results in their lead capturing and management process.

Firstly, Mailparser reduced the firm’s manual data entry time by 90%. New lead data is automatically extracted from incoming emails and converted into a structured format, which is then easily exported to their CRM with just a few clicks. This has allowed the sales team to spend more time following up with leads and advance them through the sales process from the initial contact to binding the insurance policy.

Here is how Simon describes the company’s experience with Mailparser:

“We were also able to use the web API to create an online form where our loan officers could upload these PDF forms. So, full circle, it was hands off for us to manage these documents from uploads to parsing to unpacking them into our CRM and notifying those agents.

Instead of taking 5 to 10 minutes to copy data into a CRM, [our agents] are able to just get a notification that a PDF has been parsed and everything has been created for them, saving them literally hours every day. So it’s been a huge boon for their productivity.”

Plus, the cost of data entry has drastically decreased, since employees don’t have to spend hours upon hours typing or copying data manually;

In addition to saving time and money, Mailparser has also improved the accuracy of the company’s lead data. Previously, there were frequent errors in the lead database, causing the sales representatives to act on incorrect information and therefore lose credibility and the trust of potential clients. Now, the risk of errors is practically gone as Mailparser is able to accurately extract data from emails.

Last but not least, Mailparser has allowed the insurance brokerage to scale their lead management process more efficiently. As their business grows and they receive more leads via email, the sales team can focus on contacting leads without stressing over the amount of data to enter. Mailparser can process large volumes of emails and extract key data quickly and accurately, without requiring additional effort from the sales team.

In Conclusion

The insurance brokerage in this case study used to lose time and opportunities due to manual data entry. Once the firm implemented Mailparser, the sales team was able to receive extracted lead data directly into Salesforce, where it is organized, accurate, and easily accessible.

The benefits of insurance lead parsing were immediate. The company was able to process leads much faster, allowing them to quickly follow up with potential clients and grow their business. Gone were the tedious hours of typing data by hand and verifying it for errors. Overall, implementing Mailparser has been a game-changer for that firm.

For insurance brokers looking to manage leads more efficiently, Mailparser is a simple yet powerful tool that removes the burden of data entry and boosts productivity. If you are facing difficulties with lead management and want to speed up your sales process, sign up today for a free trial and start extracting lead data from your inbox into your CRM.

Extract Data from Emails with Mailparser

Save countless hours of tedious data entry and streamline your document-based workflows.

No credit card required.