From meeting with clients to attending events and office supplies, there are many expenses that companies pay for. Whether you want to track expenses against an allocated budget or reimburse employees, you need to use an expense report. If you are looking for a simple and clear expense report template to track your company’s business expenses, try ours. No need to keep tracking expenses manually or create a template from scratch. At Mailparser, we have a free template that you can use and customize to track your costs. Keep reading to find out what it includes and get your own copy.

Capture Data from Emails Effortlessly

Save countless hours of tedious data entry and streamline your workflows.

No credit card required.

What Is an Expense Report?

An expense report is a report that lists the total expenses incurred by an employee during a period of time and for a specific purpose, like business trips, client visits, events, office-related purchases… Employees typically fill out these reports to get reimbursed for what they paid for while performing their roles. Note that an expense report can also list the expenses paid for with a budget provided by the company. Either way, expense reports help businesses stay on top of spending, and maintain accurate records for accounting and tax purposes.

Common uses

Employees fill out expense reports in many scenarios, including:

- Travel expenses: These can include airfare, hotel stays, meals, transportation, and other costs associated with business trips.

- Client meetings: If you take a client out to lunch or drive to another city for a meeting, those costs can be submitted in an expense report.

- Office supplies: Items like printer ink, notepads, or USB drives bought for work purposes can be logged and reimbursed.

- Conferences and trainings: Registration fees, hotel accommodations, and travel costs for professional development events are often tracked here as well.

What does the expense report include?

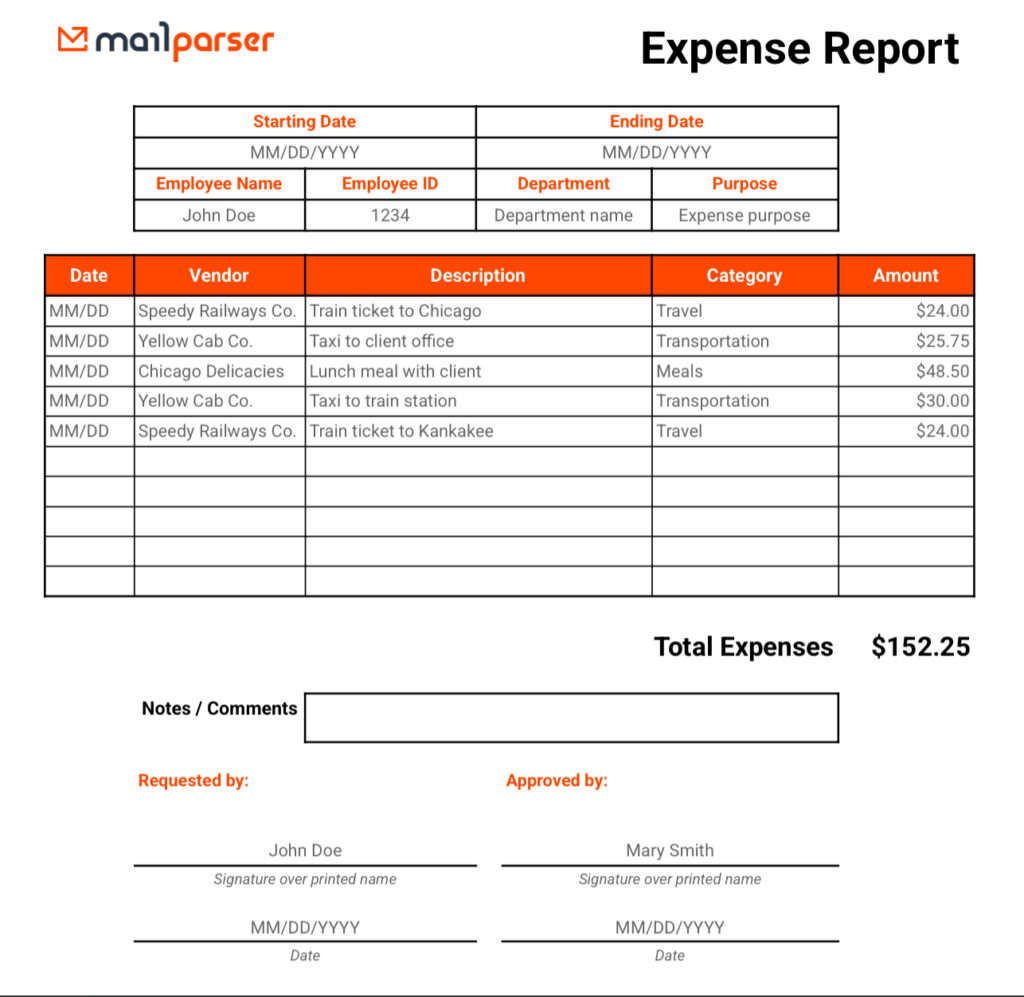

A typical expense report will include the following fields:

- Employee ID – To identify who’s submitting the expenses.

- Date – When the expense occurred.

- Vendor – Where the purchase or service was made.

- Description – A short explanation of the expense.

- Category – Such as flight, hotel, meals, transportation, etc.

- Amount – The cost of the item or service.

- Total amount – The sum of all expenses on the report.

Keeping these details consistent ensures that reports are easy to review and process — whether manually or through automation tools.

Why Do Businesses Need Expense Reports?

Expense reports are quite important for companies that incur a variety of expenses on a regular basis. As you know, they help manage finances and support employees. Let’s take a closer look at why your company may need them:

Reimbursing employees

When team members spend their own money on work-related costs, an expense report is the go-to way to ensure they’re reimbursed quickly and accurately. Instead of hunting down random receipts or emails, finance teams can rely on these reports to verify costs and issue payments.

Ensuring financial transparency

Expense reports create a paper trail (or digital record) of where the company’s money is going. With everything documented in one place, it’s easier to catch errors, flag unusual spending, and maintain compliance with internal policies or industry regulations.

Documenting expenses for tax deductions

When tax season comes, well-kept expense records can be a lifesaver. Many business expenses — such as travel, client meals, or office supplies — are tax-deductible. So accurate expense reporting helps ensure your company claims all the deductions it’s entitled to without triggering red flags.

Optimizing expenses

With detailed expense data at your fingertips, it’s easier to spot trends and make smarter budgeting decisions. You might notice that travel costs spike in certain months or that one department consistently exceeds its budget. These insights can help your business optimize costs.

Okay, it’s time for you to get your free expense report template.

Get Your Free Expense Report Template

Click on the button below:

Then, on the page that opens, click on the button ‘Make a copy’.

Next, open the ‘File’ tab in Google Sheets and click on ‘Make a copy’. That’s it! Now employees can fill out this template whenever they incur business expenses.

You can use this expense report template in Google Sheets, Excel, or any spreadsheet tool you prefer. You can also use it as a printable expense report template if you want. Essentially, you get:

- A ready-to-use structure that saves time on formatting

- A table that details the business expenses

- The total amount which is automatically calculated

Our expense report template helps you stay organized with clearly labeled columns for dates, vendors, expense descriptions, expense categories, and amounts. It’s especially helpful for small businesses, freelancers, or finance teams that want a no-fuss way to track expenses but don’t need a fully automated solution.

Want to go a step further? You can extract expense details from receipt emails into your report using Mailparser.

Automate Expense Data Entry With Mailparser

If employees typically pay for expenses with means other than cash, chances are they receive emails that contain receipts of their purchases. Instead of spending time typing information manually, they can use an email parser like Mailparser to extract key details directly into the spreadsheet that serves as an expense report. Here is what the process looks like:

- An employee sends one or several emails to their inbox in Mailparser.

- They extract the relevant data points within seconds.

- They export the parsed data points to their expense report in Google Sheets, Excel Online, Airtable, etc.

If you (or your team members) need to process receipts regularly, Mailparser helps you automate manual entry, prevent errors, and keep all the information related to business expenses organized.

Sounds interesting? Sign up for a free trial and set up your inbox within minutes.

Capture Data from Emails Effortlessly

Save countless hours of tedious data entry and streamline your workflows.

No credit card required.